INTRODUCTION

Corporate strategy refers to the direction as well as the level and scope of actions of a company in alignment with the stipulated organizational goals and objectives (Davies, 2016). Every organisation has a unique corporate strategy, which they apply to gain a strategic and competitive edge in the marketplace. It is largely concerned with the management of resources, risks, and returns done by an entity, which provides an opportunity for the firm to become a leader in the corporate world within the specific business industry. Designing and formulating an effective corporate strategy lays the foundation for the success of a business enterprise in the global marketplace and assists the entity in carrying out its operations by the targets stipulated by the management of a company.

The following report is based on Tesla Motors, which is an American automotive and energy organization that enjoys a leading position within the global marketplace. This report consists of the external business environment and industry analysis by way of PESTLE and Porter Five Force analysis. Further, it includes the resources and key competencies of the entity to determine the core competencies. And lastly, it constitutes SAFe criteria applied to a strategy executed by an organisation in the marketplace.

External Analysis (Business Environment and Industry) to Identify Opportunities and Threats and Assess Industry Attractiveness

Tesla Motors is a leading name within the vehicle manufacturing sector owing to the wide variety of cars that the entity offers to the public as per their choice and relevance. This organization has its head office located in Palo Alto, Silicon Valley. The company is mainly a car manufacturing unit established in the year 2003. The entity is one of the leading car manufacturer companies, having more than 79 stores around the world and an approximate number of 10,161 employees in its organizational structure. With the help of PESTEL evaluation, Tesla will effectively be able to analyze its opportunities and threats in the sector, including political, legal, environmental, technical, and social (Mittal and Dhar, 2015). Along with this, the present analysis also benefits companies to assess their currently present competitors within the automobile industry. In addition to this, as Tesla is looking forward to building up environment-friendly alternatives, the environment factor of PESTEL analysis aids Tesla in finding opportunities and threats effectively to stimulate its growth process:

- PESTEL Analysis

Political: The political factor consists of different types of trade regulations, such as EU & NAFTA, entry mode regulation, stability of government, social policies, and more. Tesla began its business by trading cars in the region of North America and, after that, expanded their business services in Western Europe and Asia. This expansion brings numerous political factors that influence its culture. Some of the basic political factors that have an impact on the functioning of Tesla include environmental regulations that aim towards decreasing the emissions level; it has been encouraged to produce environmentally friendly cars with this; elements of government subsidies; and other various incentives to make consumers use greener vehicles. The government institution of the US created a program in which they provide energy loan programs that will effectively encourage industries to use new vehicle technologies. For instance, in Europe, Norway's government encourages industries in the market by providing certain measures, like nationwide access to bus lanes and offering free parking of electric vehicles (Du et. al., 2013). All these political decisions adopted by countries effectively represent opportunities for Tesla to find a new market and make further investments in those markets to gain more growth and maximize the profitability of the company. On the other hand, various types of environmental regulations can result in a major threat to Tesla's ability to operate their functions smoothly and effectively, as these regulations affect the day-to-day functioning of the company.

Also, you can get our coursework help online for getting into your dream university and kickstart your future endeavour.

Economic: These factors are mainly related to the current level of inflation, economic growth rate, credit accessibility, interest rates, and more. As demand for sustainable cars rises around the globe as the price of fuel-engine vehicles is rapidly raising—with the fast-phase increment in fuel prices worldwide—this factor will work as an effective opportunity for Tesla to offer their environmentally friendly cars in the global market and acquire a large market share. Along with this, an increase in the GDP rate leads to a significant rise in the buying power of customers, which will automatically increase the sale of electric cars in the global market.

Societal change in lifestyles and trends, education level, and distribution of wealth are some of the factors that are covered in this aspect of PESTEL analyses. A social factor is related to the buying behaviour and attitude of customers related to a product or a service. In today's modern world, there is an increase in environmental awareness. Recently, individuals prefer to buy eco-friendly products rather than purchasing the pollutants ones (Engert and Baumgartner, 2016). People like to spend their money on environmentally friendly products to save both the environment and their money. Convinced individuals act as a great opportunity for Tesla to offer electric cars in the market and generate effective growth of their products on a global level to satisfy the demands of consumers on a great base.

Technological: These include new and innovative discoveries, different types of new technological platforms, and more. Technological factors effectively benefit the rapid progress of organizational effectiveness. With the adoption of highly advanced technological measures in its manufacturing process, Tesla can find numerous sets of opportunities to improve its level of efficiency and decrease the overall cost of input in the car industry. Along with this, technological factors enable Tesla to gain the opportunity to offer a wide range of car choices to customers worldwide. On the other hand, to find different types of effective technological measures for compliance, it is required for Tesla to input more cost in their R&D expenditure budget (Gnan, Montemerlo, and Huse, 2015). This will act as a threat, as it is quite hard to find out one of the most effective and suitable technological measures for a company that can effectively stimulate its growth.

Environmental: There are different types of factors included in the environmental section, such as attitude towards the environment, waste disposal law, energy consumption law, etc. As individuals all over the world are getting so much aware of environmental concerns, this factor can be seen as a threat for Tesla to face more competition to produce eco-friendly vehicles in both economical and affordable ways. While Tesla is planning to bring eco-friendly cars to the market, this concern about the environment results in an increase in high-end demand for company products in the global market, which effectively stimulates its growth.

Legal: There are a variety of legal factors that are required to be considered by companies to perform their functions in a manner desirable by law. Some of these factors include product regulation, patent infringement, health and safety regulation, employment regulation, etc. The world is leading towards go-green movements, which bring large and leading manufacturers to build vehicles in an eco-friendly way. There are different types of legal regulations implemented by the government, such as carbon tax, green policies, and more (Lam and O'Higgins, 2012). All these regulations and laws act as an opportunity for Tesla to boost their demand for electric cars in the global market. On the other hand, numerous taxation policies on green business result in a threat for Tesla to operate their business in the global market.

Also Read: Cadbury PESTLE Analysis: Relive the Golden Age of Chocolate

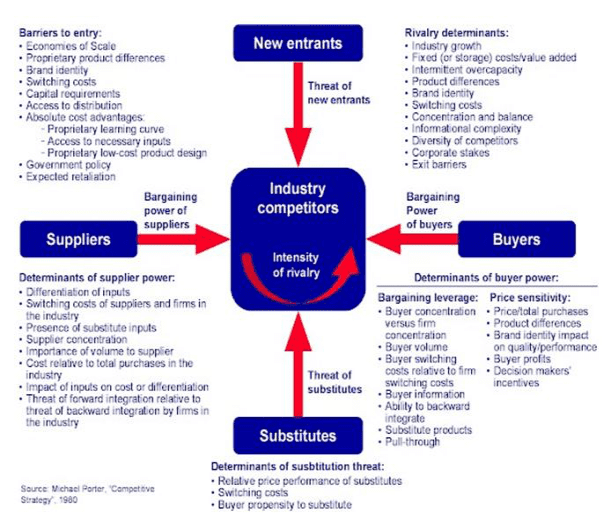

Tesco has been running successfully within the global market by making use of the opportunities that the external business environment presents and overcoming the threats that are placed by the macroenvironmental factors of the entity. Further, the manager of this organization has carried out a Porter Five Force analysis to gain knowledge of the attractiveness of the sector in which this entity operates and to identify who possesses the largest influential power within this industry. In this regard, an industry analysis of the automobile sector, relatively taking into consideration the position of Tesla, is given below:

PORTER FIVE FORCES

- Threat of New Entrants: High

The threat of new entrants within the automobile sector is low. This is so owing to several reasons. One of the most dominant reasons for this is the requirement of huge capital, which is necessary to gain entry into the automobile sector, specifically the electric vehicle segment. Also, the expertise required to carry out the high-tech operations associated with manufacturing and other related activities is not easy to gain by a new entrant. This is beneficial for companies such as Tesco to ensure its sustainability in the market for a long duration of time.

- Threat of Substitutes: High

The threat of substitution is found to be quite high within the automotive sector. In this regard, Tesla Motors faces the threat of substitution from hybrid cars, electric cars, solar power cars, and other diesel cars that are offered by rival firms within the same sector (Tesla Porter's Five Forces Analysis, 2019). Further, the threat of substitutes also exists in the case of people opting to make use of buses, traintrains, or cars as a mode of transportation instead of acquiring an electric vehicle.

- Bargaining Power of Buyers: Moderate to High

The power possessed by buyers within this sector ranges from moderate to high. This is due to the increasing awareness among customers, which makes them crave high-quality and innovative products with prices lower than those of other companies dealing with the automotive sector. If customers realize that they can get the same product at a lower price from another enterprise, they may switch to that entity (McCahery, Sautner, and Starks, 2016). Thus, it is required for Tesco to adopt diversification to keep the loyal base of customers intact.

- Bargaining Power of Suppliers: High

The bargaining power of suppliers within the automotive sector is high owing to the specific technologies that the firms operating at large scale make use of to gain a strategic edge in the marketplace over rival firms. In this regard, Tesla is dependent upon suppliers for the necessary prerequisites to utilize a lean management system across the organizational premises (Tesla Porter's Five Forces Analysis, 2019).

- Competitive rivalry: high

In the global marketplace, the competition in the automotive industry is fierce, and owing to this, the competitive rivalry is high in this sector. Various firms operating as a part of this industry offer diverse categories of vehicles as per the preferences and convenience of customers. About electric vehicles, the cars designed by Tesla have no close substitutes, yet companies such as Nissan, which produces affordable electric cars, stand a chance to outpower Tesla across the global market.

Figure 1: Porter Five Force Analysis Model

As per the analysis of the automobile sector, it has been evaluated that Tesla faces several threats, owing to which they need to focus their attention specifically towards the high quality of cars and the differentiating elements present within them to gain a strategic and competitive edge over rivals in the marketplace. Further, it has been analysed that the threat of the existence of other dominating and well-established brand names within the industry that provide close substitutes for the vehicles produced by Tesla is significant enough to take over the current share of the company in the global marketplace. This organisation has made use of hydrogen fuel to design and develop high-tech cars that possess the capability to persuade customers to make a purchase. Additionally, it has been assessed that the automobile sector is still not much accessible owing to the high capital investment that is required to be done by new entrants and the skills that are required to execute the high-tech operations to successfully tap into the industry as a key player (Herrmann and Felfe, 2014).

Analysis of Resources and Key Competences of Company to Identify Core Competences

The VRIOS framework assists an organisation in determining the areas that render the company a competitive advantage within the industry (Marsh, 2013). Identification of the most valuable skills, resources, and competences is necessary for an enterprise. In this regard, the VRIOS framework is used to analyse the resources and key competences of Tesla Motors.

VRIO ANALYSIS

V: Value-creating potential

R: Rarity

I: Imitability

O: Organization Appropriateness

|

|

V |

R |

I |

O |

STRATEGIC IMPLEMENTATIONS |

|

RESOURCES |

|||||

|

Elon Musk |

YES |

YES |

YES |

YES |

The award-winning CEO of Tesla is its most important resource. The success of company is owing to his strategic vision and leadership in the right direction. |

|

Funds & Grants Raise |

YES |

NO |

NO |

YES |

Owing to its socially responsible vision and mission as well as its promising leadership, Tesla has access to funds and grants that assist the enterprise in product launch (Tesla's mission is to accelerate the world's transition to sustainable energy, 2019). |

|

Design and engineering excellence |

NO |

NO |

NO |

YES |

Tesla vehicles, especially the Model S, are an architectural excellence, which is a result of the extreme design and engineering efficiencies within the enterprise, which act as a powerful resource for the success of this entity (Tesla's High End Disruption Gamble, 2019). |

|

|

V |

R |

I |

O |

STRATEGIC IMPLEMENTATIONS |

|

CORE COMPETENCES |

|||||

|

Innovative and creative design thinking culture |

YES |

YES |

YES |

YES |

Owing to the heavy investment of Tesla within R&D, the culture of this organisation is driven by innovative and high design creativity. The technological innovations brought in by this firm render it a competitive advantage within the industry (VRIO FRAMEWORK, 2019). |

|

Diversification strategy |

YES |

YES |

NO |

YES |

The long-term diversification strategy of this enterprise has assisted the organisation in turning itself into an innovative energy company that develops sustainable goods for the power industry. This renders a strategic as well as competitive advantage to the firm over rivals, as this is a unique concept anew to Tesla Motors. |

|

Marketing Strategy |

YES |

NO |

NO |

YES |

Owing to the lack of a well-designed and formulated marketing and advertising campaign, this organisation has not been much successful in creating awareness about electric vehicles manufactured by Tesla and its high-tech features, which regards the value that it holds within global marketplace |

|

Business Model |

NO |

NO |

NO |

YES |

Tesla's corporate as well as sales strategy is capable of providing assistance to the company in achieving their expansion goals. The owned revenue and service centers of this organisation are too expensive and not at all conducive for the attainment of sales targets. |

Figure 2: DISRUPTIVE INNOVATION DONE BY TESLA

SAFe Criteria Applied to Be a Strategy Implemented by Organisation

Over years, Tesla has been known for making use of innovation and creativity within products so as to design and develop such products which possess the capability to disrupt automotive industry as well as the overall global market place. In this regard, the strategy of the company to enter the segment of electric vehicles, taking into account the aspect that not many entities are present within this segment to compete with Tesla Motors, was excellent in terms of the strategic choice and intelligent mindset. With the passage of time, the decision of this organisation to enter this segment of vehicle production has assisted the entity in gaining increasing name and stake within marketplace (McCahery, Sautner and Starks, 2016). By introducing new models of electrical cars at regular intervals, the company strives to enhance its share in the global market with a significant quantum every time that a new product is launched into the industry that aims at disrupting the sector in terms of its high-tech features and excellent architectural design. The manager of this organisation has applied SAFe criteria to analyse the suitability, acceptability and feasibility of this generic strategy of company to adopt innovation and tap new product segments:-

Suitability: Taking into account the behavioural characteristics of their target consumers, Tesco analysed that customer prefer innovative products. This strategy of adopting innovation to tap new product segments is suitable to meet the needs and demands of people, as with this, the organisation stays aligned with the latest tools and technologies prevailing in the marketplace.

Acceptability: The generic strategy of the company to adopt innovation so as to enter new market segments such as electrical vehicles is easily acceptable by people, as customers in today's era are more inclined towards uniqueness and innovation.

Feasibility: The generic strategy of Tesco to make use of innovative practices to enter new product segments is feasible, as this renders the organization the opportunity to enable growth of business operations within the global marketplace.

To get more details about online assignments help connect with us

CONCLUSION

As per the above report, it can be concluded that corporate strategy is the key to success of an enterprise within marketplace. Also, it has been analysed with the help of PESTLE analysis that the external business environment offers a number of opportunities and threats that have to be taken into consideration by the enterprise in order to operate strategically in the market. Further, Porter Five Force analysis reveals that there is a huge threat of rivalry and substitution within the automotive industry, which causes risks for the existing companies in the sector. VRIOS analysis indicates that the resources and competences of a firm are the key to success of an organisation and should be worked upon on a daily basis to become the leader in market.

Find this sample assignment helpful?

We've got thousands of samples written around business environment. Go on, explore and let us know if you get stuck with your assignments.

We at Assignment Desk specialise in providing quality assignment writing help to students from various universities across UK.

Get your customised Business Environment Assignment Help here.

You might also find the following services useful:

Business Economics Assignment Help

Business Communication Assignment Help

REFERENCES

Davies, A., 2016. Best practice in corporate governance: Building reputation and sustainable success. Routledge.

Du, S. and et. al., 2013. The roles of leadership styles in corporate social responsibility. Journal of business ethics. 114(1). pp. 155-169.

Engert, S., and Baumgartner, R. J., 2016. Corporate sustainability strategy—bridging the gap between formulation and implementation. Journal of cleaner production. 113. pp. 822-834.

Gnan, L., Montemerlo, D. and Huse, M., 2015. Governance systems in family SMEs: The substitution effects between family councils and corporate governance mechanisms. Journal of Small Business Management. 53(2). pp. 355-381.

Herrmann, D., and Felfe, J. (2014). Effects of leadership style, creativity technique, and personal initiative on employee creativity. British Journal of Management. 25(2). pp. 209-227.

Lam, C. S., and O'Higgins, E. R., 2012. Enhancing employee outcomes: The interrelated influences of managers' emotional intelligence and leadership style. Leadership and Organization Development Journal. 33(2). pp. 149-174.

Marsh, C., 2013. Business executives' perceptions of ethical leadership and its development. Journal of Business Ethics. 114(3). pp. 565-582.

McCahery, J. A., Sautner, Z., and Starks, L. T., 2016. Behind the scenes: The corporate governance preferences of institutional investors. The Journal of Finance. 71(6). pp. 2905-2932.

Mittal, S., and Dhar, R. L., 2015. Transformational leadership and employee creativity: mediating role of creative self-efficacy and moderating role of knowledge sharing. Management Decision. 53(5). pp. 894-910.

Ocasio, W., and Radoynovska, N., 2016. Strategy and commitments to institutional logics: organizational heterogeneity in business models and governance. Strategic Organization. 14(4). pp. 287-309.

Ojokuku, R. M., Odetayo, T. A., and Sajuyigbe, A. S., 2012. Impact of leadership style on organizational performance: a case study of Nigerian banks. American Journal of Business and Management. 1(4). pp. 202-207.

Tricker, B., 2015. Corporate governance: principles, policies, and practices. Oxford University Press, USA.

Company

Company